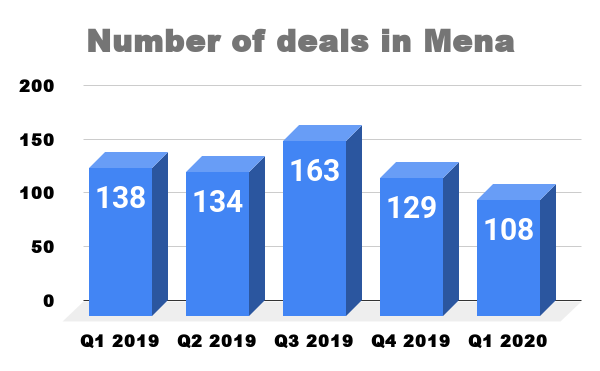

The number of investment deals in the start-up space in the Middle East and North Africa (Mena) saw a steep drop of 67% year on year in March due to coronavirus outbreak amid a 2% increase in year-on-year funding in the first quarter of the year.

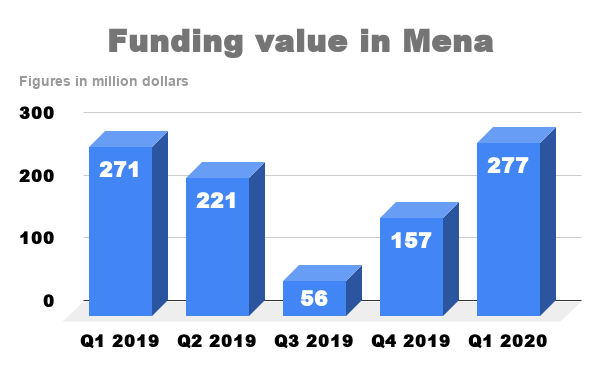

The startups raised $277m in the first quarter of this year compared to $271m a year ago, with several startups raising large funding rounds in January and February, including Kitopi ($60M), Vezeeta ($40M), and SellAnyCar ($35M).

According to the region’s largest startup data platform MAGNiTT, the number of investment deals in the first quarter of this year stood at 108, registering a fall of 22% when compared to 138 a year ago.

Philip Bahoshy, founder and CEO of MAGNiTT, said that the sector will most likely not see the full impact of Covid-19 on the venture funding space for a few months.

“It is very challenging to know exactly how Covid-19 is going to be in the next couple of quarters. We anticipate that investors will look into supporting their portfolio companies that may be challenged; there is going to be new opportunities that are going to arise out of the situation and investors that have cash are going to invest in opportunities; valuations are going to have a correction as people will not have high growth rates in this environment as they would have previously and this, in turn, is an investment opportunity for investors,” he said.

He added that the second quarter will see a slowdown in overall deals and investments.

Profitability challenged

“Some VCs have already raised funds and are looking to deploy the capital in the next couple of months and a lower valuation is good for the ecosystem. The pool of funds may be smaller but VCs are looking to invest where they can as part of business continuity,” Bahoshy said.

2019 was another record year for the region with the number of deals increasing by 31% from 2018 to 564 in 2019 while funding increasing by 13% to $704m last year, excluding previous mega deals in Careem and Souq.

Uber acquired Careem for $3.1b while Amazon acquired Souq for $580m.

Bahoshy said in January that more than $1b is expected to be invested in regional startups this year as they look to raise growth capital and also fuelled by government initiatives and matching programmes to support startups in the region.

He said that profitability will be challenged as people are not investing as they used to and “we may see a flattening in the number of deals this year and a decrease in the total value of investments”.

The Dubai-based female-founded luxury e-commerce platform - The Modist - shut down its doors on April 2 due to the current situation.

“It wouldn’t be surprising to see some startups and SMEs finding challenges in their operations and close down as a result,” he said.

Historical data highlights that investment rounds across Mena tend to take, on average, six months to come to fruition, he said, and added that early indications have already shown a slowdown in funding announcements, as startups and investors re-evaluate their positions in this new environment.

Moreover, he said that a preliminary survey poll based on more than 100 startup founders show that 59% of founders mentioned that their business had already been impacted by the crisis; 48% cited revenue generation as their major concern, with 25% pointing to fundraising as the issue that keeps them up at night while 41% anticipated lower-than-expected revenue growth rates in 2020, with 29% anticipating revenue below 2019 figures.

However, Bahoshy said that anecdotal evidence has shown increased investor appetite in startups that have seen increased activity in the current time, with grocery delivery, healthcare, e-commerce, and edtech seeing an increase in both customers and investments.

“Fundraising activity is moving online as startups and investors are quickly adapting to the new normal and startups are increasingly looking for alternative ways to fundraise during the current crisis,” he said.

- Nuat is giving a whole new spin to education through virtual reality

- Innovative ways to speed up the fight against coronavirus using drones

- Challenges and opportunities posed by Covid-19 on enterprises and remote work

from TechRadar - All the latest technology news https://ift.tt/2VqNEng